Are Property Taxes Deductible In Connecticut . state law authorizes a credit of up to $200 against the state income tax for property tax payments connecticut residents made on eligible property during the tax. you may use this calculator to compute your property tax credit, if: · you are a connecticut resident, and · paid qualifying. connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are. the connecticut property tax credit can be entered on your connecticut return by following the steps below: homes in connecticut will receive a property tax credit of up to $300, which is increased from the prior credit of $200. Even if the property was inherited through an. if you own property in connecticut, you will be required to pay ct property tax.

from taxfoundation.org

you may use this calculator to compute your property tax credit, if: if you own property in connecticut, you will be required to pay ct property tax. homes in connecticut will receive a property tax credit of up to $300, which is increased from the prior credit of $200. connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are. the connecticut property tax credit can be entered on your connecticut return by following the steps below: Even if the property was inherited through an. · you are a connecticut resident, and · paid qualifying. state law authorizes a credit of up to $200 against the state income tax for property tax payments connecticut residents made on eligible property during the tax.

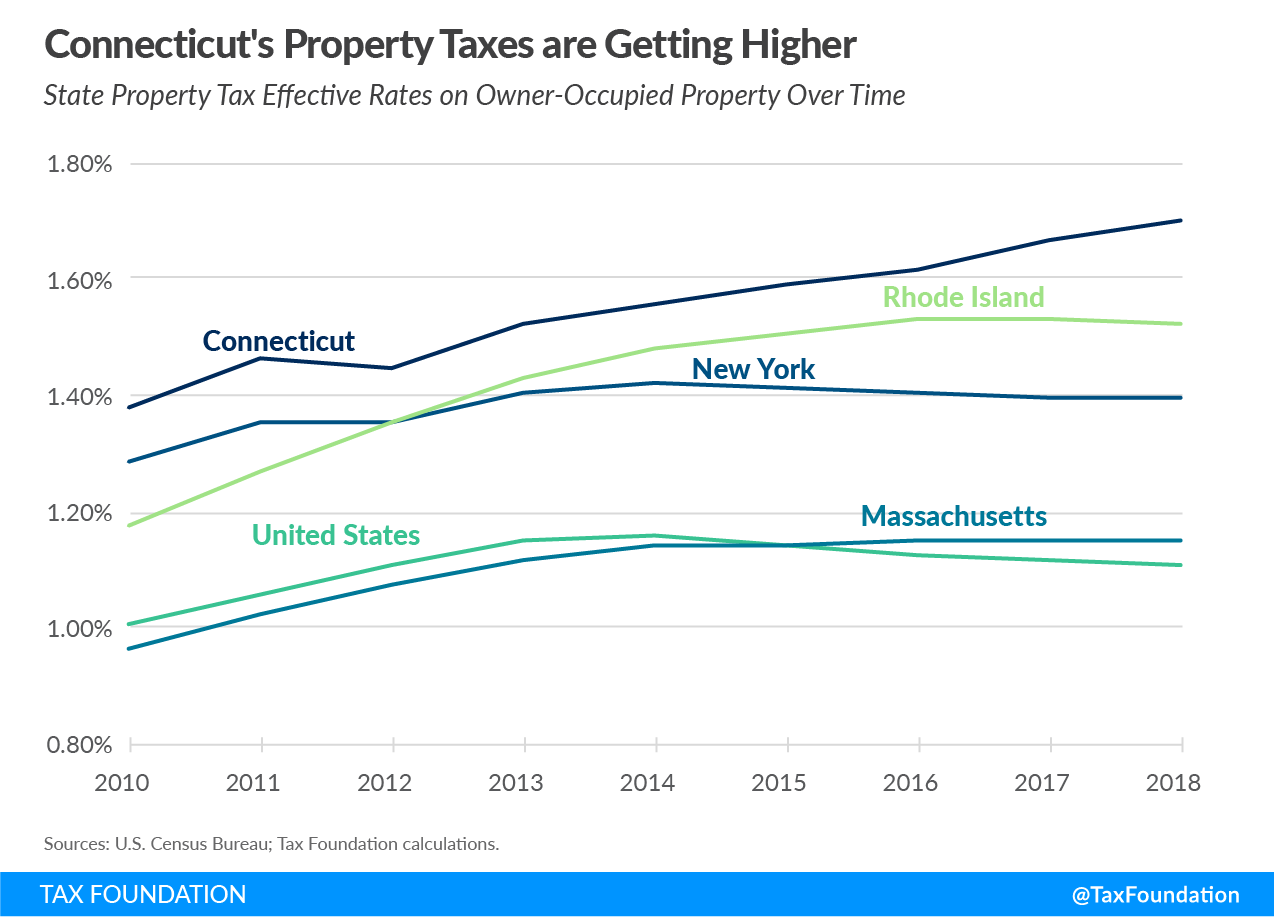

What Connecticut Can Learn from its Neighbors Property Tax Limitations

Are Property Taxes Deductible In Connecticut you may use this calculator to compute your property tax credit, if: homes in connecticut will receive a property tax credit of up to $300, which is increased from the prior credit of $200. if you own property in connecticut, you will be required to pay ct property tax. connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are. Even if the property was inherited through an. state law authorizes a credit of up to $200 against the state income tax for property tax payments connecticut residents made on eligible property during the tax. you may use this calculator to compute your property tax credit, if: the connecticut property tax credit can be entered on your connecticut return by following the steps below: · you are a connecticut resident, and · paid qualifying.

From www.pinterest.com

Property Tax Deduction Strategies For 2021 & 2022 Tax deductions, Property tax, Deduction Are Property Taxes Deductible In Connecticut if you own property in connecticut, you will be required to pay ct property tax. state law authorizes a credit of up to $200 against the state income tax for property tax payments connecticut residents made on eligible property during the tax. the connecticut property tax credit can be entered on your connecticut return by following the. Are Property Taxes Deductible In Connecticut.

From www.clearestate.com

What estate expenses are tax deductible? Are Property Taxes Deductible In Connecticut connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are. · you are a connecticut resident, and · paid qualifying. if you own property in connecticut, you will be required to pay ct property tax. state law authorizes a credit of up to $200 against the state income. Are Property Taxes Deductible In Connecticut.

From taxfoundation.org

What Connecticut Can Learn from its Neighbors Property Tax Limitations Are Property Taxes Deductible In Connecticut the connecticut property tax credit can be entered on your connecticut return by following the steps below: you may use this calculator to compute your property tax credit, if: connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are. homes in connecticut will receive a property tax. Are Property Taxes Deductible In Connecticut.

From www.youtube.com

Are property taxes deductible in 2019? YouTube Are Property Taxes Deductible In Connecticut Even if the property was inherited through an. state law authorizes a credit of up to $200 against the state income tax for property tax payments connecticut residents made on eligible property during the tax. · you are a connecticut resident, and · paid qualifying. you may use this calculator to compute your property tax credit, if: . Are Property Taxes Deductible In Connecticut.

From learningschoolsrkagger9f.z22.web.core.windows.net

Real Estate Tax Deductions For Realtors Are Property Taxes Deductible In Connecticut · you are a connecticut resident, and · paid qualifying. homes in connecticut will receive a property tax credit of up to $300, which is increased from the prior credit of $200. the connecticut property tax credit can be entered on your connecticut return by following the steps below: state law authorizes a credit of up to. Are Property Taxes Deductible In Connecticut.

From burnmyfuckinmind.blogspot.com

+18 Are Real Estate Commissions Tax Deductible 2022 Real Estate Are Property Taxes Deductible In Connecticut state law authorizes a credit of up to $200 against the state income tax for property tax payments connecticut residents made on eligible property during the tax. connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are. homes in connecticut will receive a property tax credit of up. Are Property Taxes Deductible In Connecticut.

From www.wtnh.com

Connecticut ranks among highest property taxes in the country Are Property Taxes Deductible In Connecticut · you are a connecticut resident, and · paid qualifying. state law authorizes a credit of up to $200 against the state income tax for property tax payments connecticut residents made on eligible property during the tax. the connecticut property tax credit can be entered on your connecticut return by following the steps below: you may use. Are Property Taxes Deductible In Connecticut.

From taxwalls.blogspot.com

How To Calculate Real Estate Tax Deduction Tax Walls Are Property Taxes Deductible In Connecticut state law authorizes a credit of up to $200 against the state income tax for property tax payments connecticut residents made on eligible property during the tax. if you own property in connecticut, you will be required to pay ct property tax. homes in connecticut will receive a property tax credit of up to $300, which is. Are Property Taxes Deductible In Connecticut.

From section8solution.com

Rental Property Tax Deductions What You Need to Know Section 8 Solutions Are Property Taxes Deductible In Connecticut the connecticut property tax credit can be entered on your connecticut return by following the steps below: · you are a connecticut resident, and · paid qualifying. you may use this calculator to compute your property tax credit, if: Even if the property was inherited through an. if you own property in connecticut, you will be required. Are Property Taxes Deductible In Connecticut.

From 10starshomes.com

Are Property Taxes Deductible? 10 stars property management Are Property Taxes Deductible In Connecticut the connecticut property tax credit can be entered on your connecticut return by following the steps below: connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are. you may use this calculator to compute your property tax credit, if: homes in connecticut will receive a property tax. Are Property Taxes Deductible In Connecticut.

From www.youtube.com

Are real estate taxes deductible? YouTube Are Property Taxes Deductible In Connecticut Even if the property was inherited through an. you may use this calculator to compute your property tax credit, if: connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are. the connecticut property tax credit can be entered on your connecticut return by following the steps below: ·. Are Property Taxes Deductible In Connecticut.

From ctnow.com

MAP GOP Tax Bill Could Hit Wealthy Connecticut The Hardest CT Now Are Property Taxes Deductible In Connecticut if you own property in connecticut, you will be required to pay ct property tax. you may use this calculator to compute your property tax credit, if: the connecticut property tax credit can be entered on your connecticut return by following the steps below: · you are a connecticut resident, and · paid qualifying. Even if the. Are Property Taxes Deductible In Connecticut.

From corinebjoella.pages.dev

Ct Property Tax On Electric Vehicles Daune Justina Are Property Taxes Deductible In Connecticut Even if the property was inherited through an. · you are a connecticut resident, and · paid qualifying. connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are. the connecticut property tax credit can be entered on your connecticut return by following the steps below: if you own. Are Property Taxes Deductible In Connecticut.

From www.realized1031.com

How Much of Property Taxes Are TaxDeductible? Are Property Taxes Deductible In Connecticut you may use this calculator to compute your property tax credit, if: homes in connecticut will receive a property tax credit of up to $300, which is increased from the prior credit of $200. connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those who are. Even if the property. Are Property Taxes Deductible In Connecticut.

From www.cga.ct.gov

Connecticut's Tax System Staff Briefing Are Property Taxes Deductible In Connecticut state law authorizes a credit of up to $200 against the state income tax for property tax payments connecticut residents made on eligible property during the tax. homes in connecticut will receive a property tax credit of up to $300, which is increased from the prior credit of $200. Even if the property was inherited through an. . Are Property Taxes Deductible In Connecticut.

From 10starshomes.com

Are Property Taxes Deductible 10 stars property management Are Property Taxes Deductible In Connecticut the connecticut property tax credit can be entered on your connecticut return by following the steps below: · you are a connecticut resident, and · paid qualifying. state law authorizes a credit of up to $200 against the state income tax for property tax payments connecticut residents made on eligible property during the tax. homes in connecticut. Are Property Taxes Deductible In Connecticut.

From cowderytax.com

Tax Deductions for Homeowners Cowdery Tax Are Property Taxes Deductible In Connecticut Even if the property was inherited through an. if you own property in connecticut, you will be required to pay ct property tax. the connecticut property tax credit can be entered on your connecticut return by following the steps below: connecticut laws require municipalities to provide property tax relief for specific groups of homeowners, such as those. Are Property Taxes Deductible In Connecticut.

From learningkrausovel4.z21.web.core.windows.net

Real Estate Tax Deductions For Realtors Are Property Taxes Deductible In Connecticut state law authorizes a credit of up to $200 against the state income tax for property tax payments connecticut residents made on eligible property during the tax. Even if the property was inherited through an. · you are a connecticut resident, and · paid qualifying. you may use this calculator to compute your property tax credit, if: . Are Property Taxes Deductible In Connecticut.